You are a provost at a university, and you have asked your team for a market analysis. You quickly realize that everyone defines the school’s market differently. The director of athletics points out that the college recruited athletes from across the country. The director of adult and online learning agrees that the college served the entire US market and some overseas students. Admissions and marketing say that most students, even online students, come from within seventy miles of the campus. You become a little frustrated that the college does not have a clear answer to a basic question. You also suspect that there might not be one answer—the college might serve several markets.

The First Step in Analyzing Your Academic Program Market

It is important to correctly define the markets to be analyzed. This work ensures that your data includes relevant prospects, employers, and competitors. It answers two questions

- Where do our current students come from?

- Where are the other students we aspire to reach?

Just a few years ago, these were difficult questions to answer. Geographic analysis, drive time, and distance calculations required esoteric software that few people could use. These days, determining geographic markets served is fairly easy.

The first step in determining your markets is to pull students’ home addresses. The college may have several addresses on file for each student. For example, you may have a current home address and the student’s school year address in off-campus housing. The best address for this analysis is the home address, sometimes called the permanent address, that the student used when applying to college. This address is in the market that your students originally came from.

Mapping Where the Students Are

When we do the work, we use mapping software to geocode the student addresses into census tracts. We use tracts for several reasons. Their geographic boundaries are well known, they are

included in many mapping applications, and the shape files are free to download. They are highly detailed. There are 73,057 tracts in the US, and on average, each one has four thousand people. Census tracts align precisely with state borders and census data on population and demographics. You may use zip codes instead. There are 41,702 zip codes, so they are 43 percent less detailed than census tracts. Zip codes do not align neatly with state boundaries and census data. They do have a virtue—they do not require use of any personally identifiable information, such as student addresses. Larger geographic units, such as counties and cities, are usually too big to be useful in determining the market you serve. They may stretch for dozens of miles and over an hour of drive time.

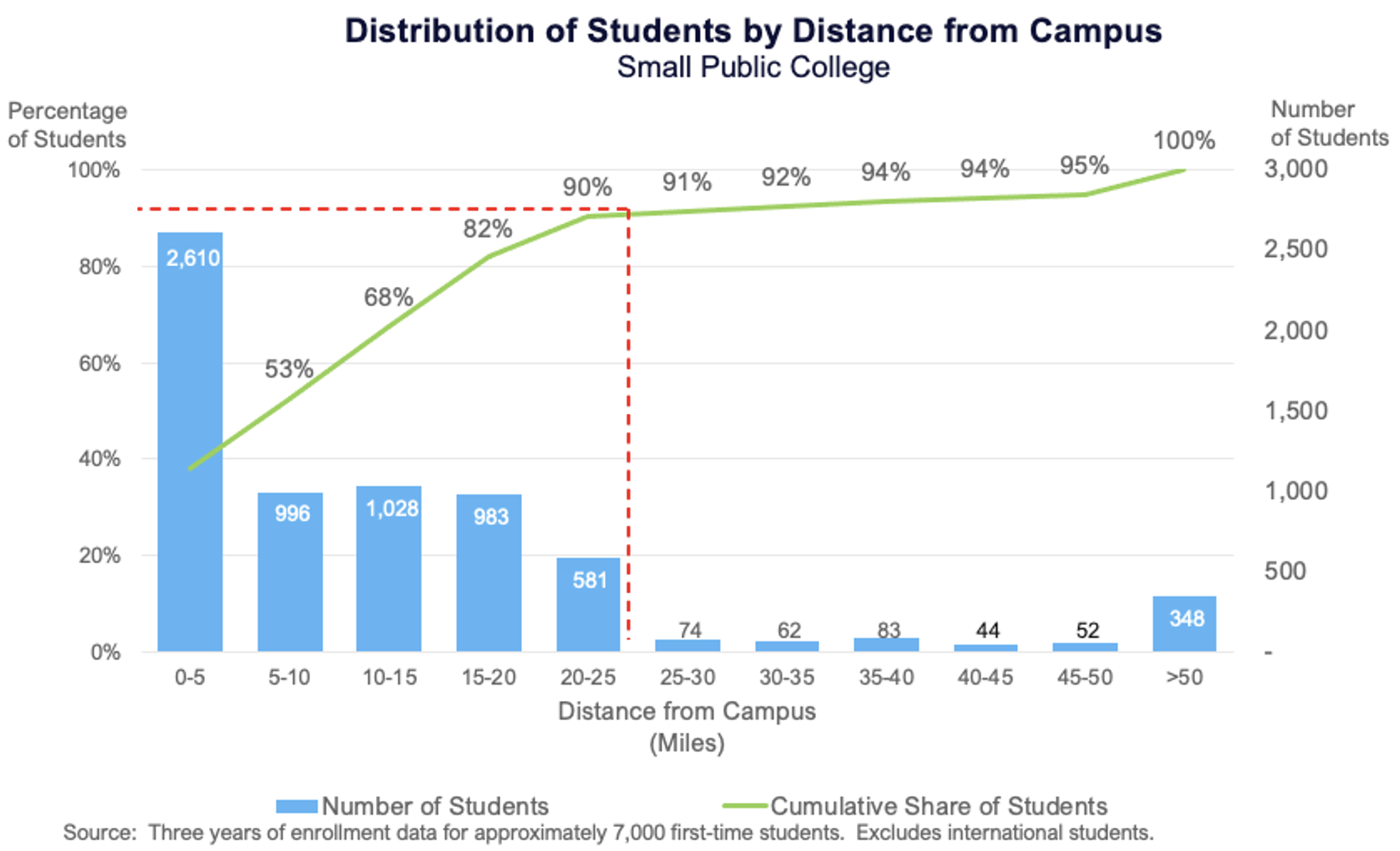

Calculate Distance to Campus

At this point, you’ll have counts of students by tract or zip. The next step is to calculate the distance from your campus to every tract or zip in your data. Online students are addressed below. Then you can add up students by distance from campus. We find it helpful to create a chart like the following one that shows the cumulative percentage of students by distance from campus. In this case, about 90 percent of students come from within twenty-five miles of campus.

Special Considerations When Calculating College Markets

For some colleges, the definition of markets is more complex. I remember a religious school whose students came from pockets spread across the nation. In this case, it made sense to find the areas where church members tended to cluster. These areas could then be grouped into one “market.” For online programs, broader market definitions may also make sense, even if they are aspirational. In most cases, at Gray DI, we use the local, regional, and national markets for online. It is also worth exploring whether definitions should vary by academic program. Some programs will attract commuting and residential students from quite a distance. Nursing is a good example. Seats in nursing programs are constrained by clinical sites and state boards of nursing; as a result, interested students will travel farther to find a school that will accept them. Other programs, like medical assisting, often draw most of their students from an area less than ten miles around the campus.

While you may not evaluate international as a separate market, it can be an important group of potential students. In some programs, like master’s degrees in computer science, the majority of students in the US come from overseas (I suspect US students with computer science skills are too busy making money to go to graduate school). These could be full-paying students in your programs, so we suggest including data on international demand to supplement your local or US data.

Finally, there is no need to rely on just one market definition. You may need one for your campus-based programs, another for online, and still another for graduate programs. This implies more work pulling data for each of several market definitions. However, once the work is done, it is relatively straightforward to use one definition for one set of questions or programs and a different one for others.

Defining your markets may seem intimidating initially. However, it is an important process that will allow you to discover new opportunities for your institution and create a collaborative program evaluation system.