The following article is an excerpt from Start, Stop or Grow? A Data-Informed Approach to Academic Program Evaluation and Management

The traditional source for program-specific data on competition is IPEDS, specifically its completion data. It will identify who your competitors are by program, how large their programs are, and how fast they are growing. With it, you can calculate your market share by program and see if it is growing or shrinking. IPEDS can also show if your competition has launched a new program, closed one, or gone out of business. IPEDS completion information is somewhat out of date, since it takes years to produce the first reported completion in a new program or to teach out an existing program. Despite these weaknesses, IPEDS is an unusually complete gauge of the number, size, and share of on-ground competitors; in many other industries there is no comparable public source of data.

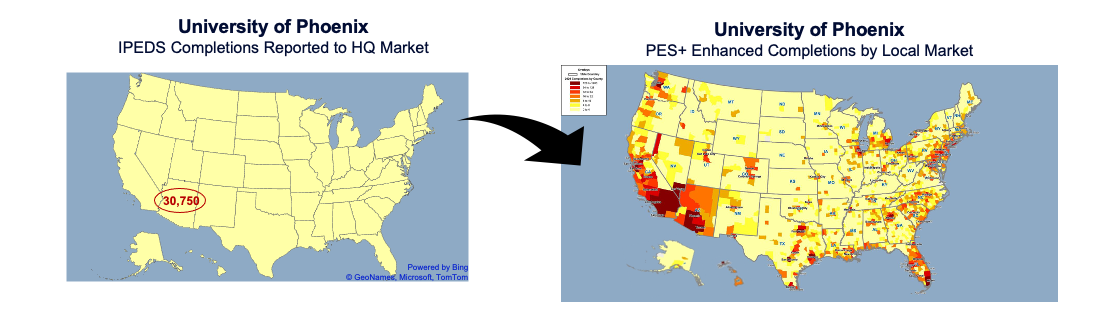

There is a catch. IPEDS misallocates most online completions, reporting them in the home market for the institution. If you are in Phoenix the market will appear highly saturated by thousands of online completions from Grand Canyon University, the University of Phoenix, and ASU Online, even though the vast majority of these students are not in Phoenix. This reporting bias can be addressed using NC SARA data for online student enrollment by institution and state of student residence. Below is an example that shows Gray’s relocation of University of Phoenix graduates from Phoenix to their home markets.

The analysis reveals who is really competing in local markets. For example, in the Washington DC market, according to IPEDS, the top two online competitors are George Washington University with 2,121 completions and Strayer University with 1,700. Both institutions have large national online programs, and the majority of their online students are not in DC.

Using NC-SARA, we found that the top two local competitors were not George Washington and Strayer, they were the University Maryland Global Campus a half-hour drive north in Maryland, Johns Hopkins an hour away in Baltimore, and Walden University, halfway across the country in Minnesota. Only the fourth-ranking competitor, George Washington University, was actually located in Washington DC. As this example illustrates, the biggest national online institutions are significant competitors in local markets across the country, particularly in specific programs, such as RN to BSN.

Nationally, there are several online institutions with over one hundred thousand students enrolled. They include Western Governors University, Southern New Hampshire University, the University of Phoenix, Grand Canyon University, and Liberty University. As a group, these institutions spend hundreds of millions of dollars a year on marketing. To understand their impact, my team monitors local Google search volume by institutional brand name. In one local market in Pennsylvania, Google search volumes for each “national” online brand were just 30% lower than the local colleges, small gap that is likely to close as the online competitors continue to advertise throughout the country.

Robert G. Atkins created Start, Stop or Grow? A Data-Informed Approach to Academic Program Evaluation and Management for anyone who seeks a proven system for making better academic program decisions at their college, university or institution of higher education or adult learning. Click here to order your copy through Amazon.