PES Software

What is PES Software?

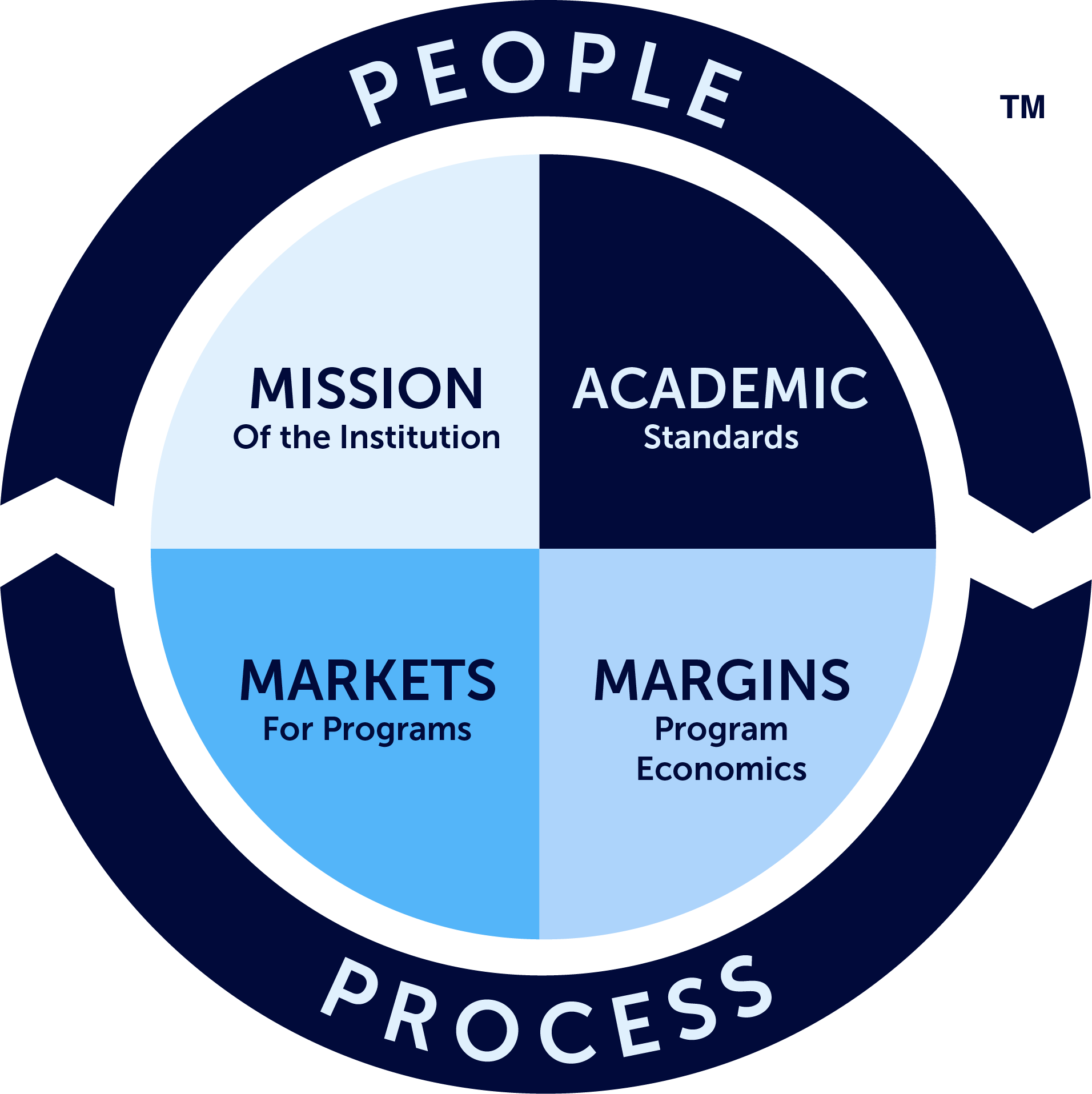

Gray Decision Intelligence PES software helps higher- education institutions make better-informed decisions that improve growth, efficiency, and student success. The Gray academic Program Evaluation System (PES) is the only platform that provides data by program on external markets and institutional performance.

PES Markets includes data on student demand, jobs, skills, and competition for over 1,500 academic programs. It predicts potential enrollment for your current and new programs. It corrects completions; for example, 200,000+ online students are usually shown at headquarters’ locations; Gray reports them where they live.

PES Economics and Outcomes measures internal academic performance, including actual and benchmark revenue, cost, margin, retention rates, and faculty productivity by program and department.

Gray DI is integrating AI. Our PES enables clients to ask questions in plain English and get the data and visualizations they seek. Our reports will include AI-drafted summaries of results, predictions, and other features we will soon imagine.

PES Software from Gray DI:

PES Economics and Outcomes

PES Economics and Outcomes offers the following:

- Economic Tracking: Assists in tracking revenue, cost, and margin by college, department, program, and course, aiding in enhanced financial decision-making.

- Outcome Evaluation: Supports student outcomes assessment and identification of equity gaps, assisting in outcome improvement and retention strategies.

- Benchmarking: Sets data-informed goals for program improvement by comparing your revenue, costs, margins, and outcomes by course level and subject area with other institutions.

PES Markets

PES Markets gives you the following:

- Market Insight: Provides invaluable information on student demand, competition, wages, skills, and jobs across over 1,000 academic programs and 6 award levels.

- Strategic Planning: Enables the identification of growth opportunities and allows a data-informed approach to program planning and development.

- Competitive Analysis: Offers insights into the competitive landscape of academic programs, informing resource investments and market positioning strategies.

Academic Management

PES Academic Program Management Dashboards presents you with the following:

- Budget Oversight: Offers a snapshot of KPIs for academic programs for efficient budget allocation and management.

- Instructional Economics: Helps in assessing the economics of each program, allowing for optimized allocation of financial resources.

- Continuous Improvement: Highlights improvement areas and accreditation preparation, potentially enhancing the institution's financial stability and reputation.

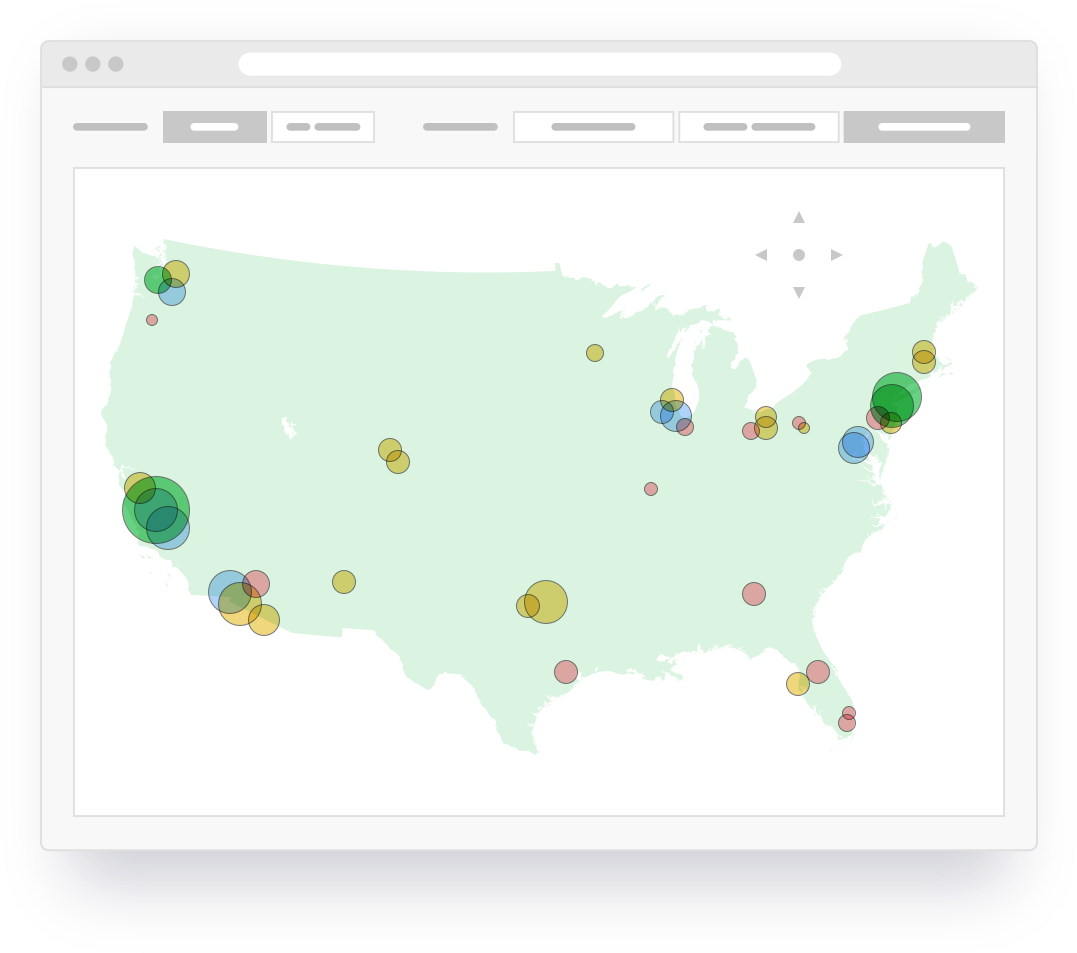

GeoTargeting

Gray DI GeoTargeting offers insight into the following:

- Targeted Recruitment: By identifying markets where individuals are more likely to enroll in their institution, deans can focus recruitment efforts more efficiently, attracting a larger pool of potential students.

- Optimized Marketing Investments: GeoTargeting ensures that marketing and admissions investments yield the highest ROI by targeting the most promising markets, ensuring resources are used effectively.

- Revenue Growth: A targeted approach based on GeoTargeting insights can increase student enrollment, subsequently boosting revenue. This increased revenue can then be reinvested in marketing and other areas, supporting a continuous growth cycle for the college.

Data Dashboards

PES includes access to the Markets Data Dashboards, which offer robust datasets on job postings, keyword searches, enrollment, non- degree demand, international student demand, and athletics resumes.